How to Start a Business in Wisconsin — Checklist Download

Stay on task and cover your bases with our detailed checklist.

Download NowHow to Start a Business in Wisconsin:

Thanks to the low burden of regulatory and tax obligations, and its booming healthcare, entertainment, and agriculture industries, Wisconsin can be a lucrative place to start a small business.

Follow our complete step-by-step guide with helpful information on how to start a business in Wisconsin.

Form your business.

Review Wisconsin formation options.

Wisconsin offers four ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

There is no need in Wisconsin to file any formation documents when starting a sole proprietorship. You will only have to register your business name and apply for any licenses and permits you need.

Name your business.

For LLCs and corporations, you will need to verify that your business name is different from the names of other businesses already registered with the Department of Financial Institutions (DFI). You can check if your name is available by searching the business name database.

For sole proprietorships or partnerships, if your business name doesn't include the owner/s name or surname, you can file a Registration of Firm Names with the Register of Deeds in the county where your business is situated.

If you need help finding a business name, be sure to check out our free business name generator.

Once you verify that your business name is available, you can file a Name Reservation Application with the DFI and reserve it for 120 days.

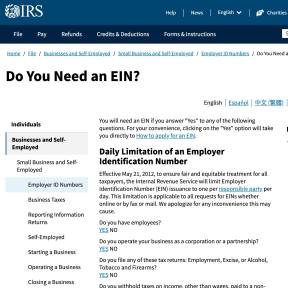

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

In addition, it's important to note that an EIN is needed if your business is taxed separately from you. Many banks also require an EIN to open a business account.

Register your business in Wisconsin.

Once you've chosen the appropriate legal structure, you must register your business with the Wisconsin Department of Financial Institutions.

If you're forming an LLC in Wisconsin, you need to file Articles of Organization and pay a filing fee of $130.00. If you choose to file by mail, it will cost you $170.00. Corporations follow a similar process. However, their documents are called Articles of Incorporation and the filing fee is $100.00.

To register your business, use the One Stop Business Registration. With this helpful source, you can register your business with multiple agencies, including the Department of Financial Institutions and the Department of Workforce Development.

It costs between $100.00–$130.00 to register a business with the Wisconsin Department of Financial Institutions.

Obtain necessary permits and licenses.

To legally operate your business, you may need licenses and permits. For example, if you plan on selling liquor at your business, you need a liquor license.

Most Common Permits in Wisconsin:

- Seller's Permit.

- Consumer’s Use Tax Certificate.

- Use Tax Certificate.

- Withholding Tax Number.

To learn about or apply for tax-related licenses, you can contact the Wisconsin Department of Revenue. However, other regulatory licenses and permits are managed through the Department of Natural Resources and the Department of Health Services. For information about Wisconsin licenses and permits, check the websites for any cities or counties where your business will be located.

Businesses that offer professional and occupational services are required to obtain special licenses and permits from various departments. To find out about the different state licenses and permits for professional services, visit the Wisconsin Department of Safety and Professional Services (DSPS). On the DSPS website, you'll find different sections with information including Business Professions, Health Professions, and Trades Professions.

To legally operate your business in Wisconsin, you may need specific licenses and permits. However, there is no statewide license available.

It's vital that you keep up to date with the latest developments in state laws and regulations. Over time, the requirements of permits and licenses can change, potentially affecting your business and industry.

To sell products on Etsy, you will be required to have a seller's permit.

Register your business for taxes.

Register for sales tax.

If your business is selling goods, you need to register for sales tax with the Department of Revenue (DOR). This tax applies to any individual, partnership, corporation, or other business that's make sales through rentals, leases, and retail products.

You must apply for a seller's permit at least three weeks before opening. If you're buying a franchise or established business, you are not allowed to take over the previous owner's seller's permit. You must apply for a new permit.

You can register for both taxes using the state’s One Stop Business Portal or the DOR’s online registration site.

Register for withholding tax.

If you plan on hiring employees, you will also need to register for employer withholding taxes with the Wisconsin Department of Revenue. If you feel that you do not meet the state's requirements to pay withholding tax, verify by checking the state's withholding tax criteria.

You can register online using My Tax Account or you can complete an Application for Business Registration. There is a filing fee of $20.00.

Register for premier resort area tax.

Premier resort area tax refers to a local retail sales tax that ranges between 0.5% and 1.25%, depending on your municipality. The premier resort area tax applies to those who sell, license, lease, or rent taxable products and/or services. These include department stores, amusement parks, gasoline services, retail bakeries, variety stores, and more.

You can report and pay your premier resort tax using the My Tax Account platform. For information, check out the premier resort area tax instructions.

Hire employees and report them to the state.

Go to the Wisconsin New Hire Reporting Center website.

Federal and state law require that Wisconsin employers report all new and re-hired employees to the Wisconsin New Hire Reporting Center. Whether your employees are full-time, part-time, or temporary, you need to report them within 20 days. If an employee has been separated from your business for 60 consecutive days, you need to report them as a new employee.

This process has to be repeated with every new employee.

For quick and easy reporting, use the online option. You can also download, print, and fax or mail the New Hire Reporting Form. Mailing information is available on the form.

Get workers' compensation insurance.

Wisconsin employers who hire one or more employees are required to carry workers' compensation insurance. Under Wisconsin law, this applies to all employees. For more detailed information about exemptions and general workers' compensation information, visit the Department of Workforce Development.

Display mandatory business posters in the workplace.

The Wisconsin Department of Workforce Development requires all businesses to display mandatory posters that share important information about employee benefits, wages, and more.

Mandatory State Business Posters:

- Employee Rights Under Wisconsin's Business Closing/Mass Layoff Law.

- Hours and Days of Work Minors May Work in Wisconsin.

- Employee Protections Against Use of Honesty Testing Devices.

- Fair Employment Law.

- Family and Medical Leave Law.

- Wisconsin Bone Marrow And Organ Donation Leave Act.

- Minimum Wage Rates.

- Workers With Disabilities Paid At Special Minimum Wage.

- Notification Required for Cessation of Health Care Benefits.

- Retaliation Protection For Health Care Workers.

- Notice to Employees About Applying for Wisconsin Unemployment Benefits.

- Public Employee Safety and Health.

- Hazardous Chemicals in the Workplace.

Wisconsin Business Types:

1. Sole Proprietorship.

This is the least formal structure available. There is no need to file articles of incorporation/organization. However, you may need to file a DBA (doing business as) in order to legally operate your business under a fictional name. Because there is nothing protecting you from business liability, a sole proprietorship has the highest risk.

2. Partnership.

A partnership is established when two or more business associates decide to do business together. In this agreement, all partners share managing roles, liability, and profits. In Wisconsin, there are no official filing or registration requirements required to create a partnership. However, all partnerships must adhere to the state's registration, filing, and tax requirements that are applicable to any business.

3. Limited Liability Company (LLC).

A Limited Liability Company is a corporate structure whereby the members of the company are not personally liable for the company's debts or liabilities. To form an LLC in Wisconsin, you must file Articles of Organization with the Wisconsin Department of Financial Institutions and pay a filing fee of $130.00.

4. Corporation.

Corporations are more formal than an LLC and include a board of directors, corporate offices, and shareholders. The profit will be claimed on the shareholders' personal tax returns. Shareholders are limited to 100. To form a corporation in Wisconsin, you must file Articles of Incorporation with the Wisconsin Department of Financial Institutions and pay a filing fee of $100.00.

Wisconsin Registration and Business Fees:

Fee Type | Cost |

|---|---|

Name Reservation | $15.00 |

Articles of Organization | $130.00–$170.00 |

Articles of Incorporation | $100.00 |

Certificate of Limited Partnership | $70.00 |

Certificate of Limited Liability Partnership | $100.00 |