How to Start a Business in Texas — Checklist Download

Download this useful Starting a Business in Texas checklist in PDF format to kickstart your business.

Download NowHow to Start a Business in Texas:

Setting up a business in Texas is relatively quick and affordable. The Secretary of State allows businesses to file formation certificates online using a user-friendly e-filing tool.

While Texas has a favorable tax environment, one that does not impose an income tax, for example, all businesses require a sales and use permit and must pay Sales Tax. Texas also has a Franchise Tax which is imposed on some businesses with revenues greater than the state-determined tax threshold.

Form your business.

Review Texas formation options.

Texas offers six ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

All businesses in Texas must file a unique business name with the Texas Secretary of State or the county clerk's office. This can be done online and will cost about $20.00.

Before registering your business name you'll need to use the SOSDirect search tool to check if the name is available. If it is, you'll need to File a Name Reservation application to reserve your chosen business name for 120 days. And, while it isn't a requirement, the state suggests you check the U.S. Patent and Trademark Office's database to ensure no-one has trademarked the name.

If you need help finding a business name, be sure to check out our free business name generator.

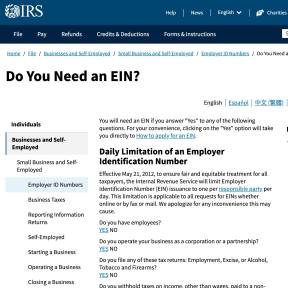

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

Register your business in Texas.

In Texas, sole proprietorships and general partnerships do not need to file any formation documents, but to form a corporation or limited liability company you need to file a certificate of formation with the Texas Secretary of State. The cost of formation depends on what business structure you decide on.

File online using SOSDirect.

Read and understand all the information there and then click "enter site."

Set up an SOSDirect account.

To register for an account, click "request a SOSDirect Account" near the bottom of the page, beneath the login and password fields.

Provide your information.

Provide contact information and type in a password.

In the correct fields, provide a street address, phone number, and email address. Then, submit and confirm a password. Click "continue."

Obtain necessary permits and licenses.

Check the Texas Department of Licensing and Regulation licenses page to see if your business needs a license.

Common licenses include:

Register your business for taxes.

Register an unemployment tax account.

All employers in Texas are required to pay unemployment tax and therefore need to register an account with the Texas Workforce Commission. The average tax rate is $27.90 on the first $9,000 of each employee's wages.

Registration is free.

Fill out the online tax registration form.

Submit your personal and new login information and set security questions. Click "Next."

Answer the questions about your business.

Wait for your TWC Tax Account Number.

Register for state and local sales and use tax.

In Texas, any individual or business selling personal property, renting personal property, or selling taxable services must apply for a sales permit from the Texas Comptroller. It is free and takes up to three weeks.

The sales and use tax imposed by the state is 6.25% on sales of goods and services, and local taxing jurisdictions can further impose another 2%.

Apply for your sales tax permit online.

Go to the Texas Online Taxes Registration Application page and click "Apply for Permit via eSystems."

Sign up.

If you have an account, login with your username and password. To register an account, click "Sign Up."

Create a profile.

Fill in the form. Include your name, user ID, email address, and mobile number. Create and confirm a password. Click "Continue."

Set up security questions.

Accept the terms of use.

Confirm.

File for franchise tax.

Most businesses with annual revenues greater than $1.18 million must pay a Franchise Tax. The franchise tax in Texas is between 0.575% and 1%. Companies with annual revenues less than the $1.18 million threshold need not pay the tax.

Certain other entities are exempt from this tax regardless of revenue. Check the franchise tax page on the Comptroller website for more information.

You do not need to register with the Texas Comptroller to set up a Franchise Tax account for your business. The comptroller sets one up for you using the information provided by the Secretary of State. You need only provide accurate information through a questionnaire.

Wait for an official letter from the Texas Comptroller.

Login to the Texas Comptroller eSystems.

Use your existing password and username if you have one, or click on "First-time user Sign-up."

Create a profile.

Include contact information and security questions and answers.

Enter your Webfile number.

Complete the questionnaire.

Register for business property tax.

While the state does not impose a property tax on businesses, local tax administrative bodies (taxing units) do. These taxing units include school districts, counties, cities, and special districts. The tax rate is subject to annual appraisals and depends on the market value of the property.

Read the Texas Property Tax Basics document in PDF provided by the Texas State Comptroller for more information.

Approach your local tax authority to register properties eligible for the local Property Tax.

Hire employees and report them to the state.

Report new employees to the state.

Employers in Texas are required by law to report new hires or rehires to the Child Support Division of the Office of the Attorney General within 20 days of the hire.

Go to the Child Support Employer Home Portal.

Click on "Submit New Hires."

Click on "Request a User ID and Password."

Submit the required information.

Texas Business Types:

1. Sole proprietorship:

Texas sole proprietorships are the most common form of business and do not need to file a certificate of formation with the state. If the business is run under a name that is not the owner's last name, then an assumed name certificate should be filed with the county clerk.

2. General partnership:

A general partnership is when two or more people join to run a business for profit. And while these partnerships tend to be situated around a partnership agreement there is no need for it to be in writing. Texas does not require general partnerships to file with the state.

As with a sole proprietorship, an assumed name certificate should be filed in the case of a business operating under a name that isn't one of the partners' last names.

3. Corporation:

A corporation is a legal entity with central management, limited liability characteristics, and transferability of ownership interests. Owners of a corporation are called shareholders and the managers of the business's affairs are directors. Corporations can elect to be "S" corporations, which is a federal tax election, by filing with the IRS.

Texas corporations are created by filing certificates of formation with the Texas Secretary of State. They can be filed online through SOSDirect.

4. Limited Liability Company:

A limited liability company (LLC) is a type of entity that has the characteristics of a corporation and a partnership. Members of an LLC are not fully liable for the company's debts and liabilities. They are only liable to the extent of their personal financial investments in the company.

The company is not taxed, but rather each partner is taxed on their share of the profits. These entities have a flexible management structure.

Texas limited liability companies are created by filing certificates of formation with the Texas Secretary of State. They can be filed online through SOSDirect.

5. Limited Partnership:

A limited partnership is a partnership centered around a written partnership agreement in which one of the partners manages the business and is fully liable for its debts and liabilities, and the other has no management rights and limited liability as in an LLC.

Limited partnerships need to file certificates of formation with the Texas Secretary of State. They can be filed online through SOSDirect.

6. Limited Liability Partnership:

A limited liability partnership is a limited partnership that has opted to limit the liability of all the general partners. The Texas Secretary of State provides a form for registration as a limited liability partnership online.

Texas Business Formation and Registration Fees:

Fee Type | Cost |

|---|---|

Texas Business Formation and Registration Fees | $300.00 |

Certificate of formation for a Texas professional association or limited partnership. | $750.00 |

Certificate of formation for a Texas nonprofit corporation or cooperative association. | $25.00 |

Registration or renewal as a Texas limited liability partnership or LLLP | $200.00 per partner |

Foreign entity application for registration. | $750.00 |

Foreign nonprofit corporation, cooperative association, or credit union application for registration. | $25.00 |