South Carolina Business Checklist Download:

Download this useful business checklist in PDF format to help you start your business in South Carolina.

Download NowHow to Start a Business in South Carolina:

The different departments involved in setting up a business in South Carolina have all made easy-to-use online tools available. This makes starting a business in the state simple and straightforward. There are plenty of resources to help.

The state has a lot of regulations around professions, so it is likely you will need professional licenses and permits.

Form your business.

Review South Carolina formation options.

South Carolina offers 4 basic ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

In South Carolina, your business name is registered when you file formation documents with the state. The online formation process starts with a basic name search. And, while it isn't a requirement, the state suggests you check the U.S. Patent and Trademark Office's database to ensure no one has trademarked the name.

Names can be reserved online or by downloading the relevant form and mailing it to the Secretary of State.

Business names in South Carolina are required to contain a word or abbreviation showing what type of business entity the business is. For example, “corporation,” “company,” “LLC,” or “LP.” Names must be distinguishable from any existing business in the state, including reserved names.

If you need help finding a business name, be sure to check out NameSnack's free business name generator.

Create a South Carolina Business Entities Online account.

Click "Start a New Business Filing."

Provide your email as a username and create a password.

Click "Complete your registration" in the verification email.

Log in using your new password and username.

Search for your business name using the tool.

If the name is available, click "Add New Entity."

Choose whether your business will be a domestic or foreign entity.

Choose "Reservation" from the drop-down menu.

Choose the relevant form.

Click "Start Filing."

Complete the form.

Pay the reservation fee.

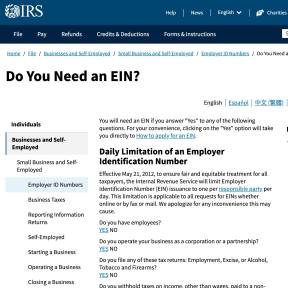

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an Employer Identification Number.

Register your business in South Carolina.

The best way to register a business in South Carolina is online. The South Carolina Business Entities Online tool can be used to file formation documents, retrieve documents, and search for corporations.

Create a South Carolina Business Entities Online account.

Click "Start a New Business Filing."

Provide your email as a username and create a password.

Click "Complete your registration" in the verification email.

Log in using your new password and username.

Set security questions.

Do a basic business name search.

If the name is available, click “Add New Entity.”

Choose whether your business will be a domestic or foreign entity.

Choose a business type.

Choose the relevant formation document.

Click "Start Filing."

Complete the online form.

Review the information you've provided.

Confirm that all the information is correct.

Pay the filing fee.

Obtain necessary permits and licenses.

There is no general statewide business license in South Carolina, but businesses operating in certain areas might require licenses or permits. Check the South Carolina Labor, Licensing, and Regulation licenses page to see if your business needs a license. Some counties require a business license.

Common licenses include:

- Accountancy.

- Barbering.

- Dentistry.

- Forester.

- Landscape architect.

- Occupational therapy.

- Real estate.

- Residential builder.

For more licensing information, visit the South Carolina Business One Stop.

Register your business for taxes.

Register for corporate income tax.

All C corporations must register for corporate income tax with the South Carolina Department of Revenue. The corporate tax rate on taxable income is 5%. Registration, filing returns, and making payments can be done online using MyDORWAY.

For more information visit the Department of Revenue's C Corporation page.

Go to the MyDORWAY portal.

Click "Register a New Business or Tax Account."

Read the requirements.

Click "Next."

Select a type of registration.

Choose a type of ownership.

Provide taxpayer information.

Add shareholders.

Complete the registration process.

Register for partnership tax.

All partnerships must register for partnership tax with the South Carolina Department of Revenue. The partnership tax rate on taxable income is 5%. Registration, filing returns, and making payments can be done online using MyDORWAY.

For more information visit the Department of Revenue's Partnership page.

Go to the MyDORWAY portal.

Click "Register a New Business or Tax Account."

Read the requirements.

Click "Next."

Select a type of registration.

Choose a type of ownership.

Provide taxpayer information.

Add partners.

Complete the registration process.

Register for sales and use tax.

In South Carolina, there is no general sales and use tax. Each industry is taxed differently. Check what your sales and use tax responsibilities are by visiting the Department of Revenue's Sales and Use Tax Index.

Go to the MyDORWAY portal.

Click "Register a New Business or Tax Account."

Read the requirements.

Click "Next."

Select a type of registration.

Choose a type of ownership.

Provide taxpayer information.

Add owners, shareholders, partners, members, etc.

Complete the registration process.

Register for withholding tax.

All employers need to register with the Department of Revenue in order to withhold personal income tax from each employee's wages. This is then paid to the Department of Revenue.

Use the latest Withholding Tax Tables to know how much to withhold from each employee.

To calculate withholding tax, use the South Carolina withholding tax formula.

Go to the MyDORWAY portal.

Click "Register a New Business or Tax Account."

Read the requirements.

Click "Next."

Select a type of registration.

Choose a type of ownership.

Provide taxpayer information.

Complete the registration process.

Hire employees and report them to the state.

Report new employees to the state.

All employers in South Carolina must report new hires as well as rehires to the South Carolina Department of Social Services within 20 days of the start of employment. This can be done online using the South Carolina New Hire Reporting online tool.

Click "Register Now."

Create a username and password.

Provide employer details.

Provide business address and contact information.

Click "Submit."

Once your account has been set up, report an employee.

Enter information about the employee and the nature of employment.

File for unemployment insurance.

All employers are required by law to contribute to the South Carolina unemployment insurance program. Businesses must register with the Department of Employment and Workforce, which can be done online.

Beneath "Register for an Account," click "Employers."

Create a username and password.

Answer the questions provided.

Enter information about your business.

Include business addresses and contact details.

Provide your NAICS Classification information.

Enter information about the owner of the business.

Submit.

Display the mandatory posters in the workplace.

In South Carolina, employers are required by federal and state law to put up certain labor-related posters where all employees can see them. Consult the South Carolina Department of Labor, Licensing, and Regulation website for more information about these mandatory posters.

Occupational Safety and Health.

Payment of Wages.

Child Labor Law.

Workers' Right to Know.

Workers’ Compensation Law.

Employee Polygraph Protection.

New Federal Minimum Wage.

Migrant and Seasonal Work Act.

Family and Medical Leave Act.

South Carolina Business Types:

1. Sole Proprietorship.

Sole proprietorships are the simplest business structure. Generally owned by a single person, they make doing taxes easy because the owner's personal finances aren't separate from those of the business. However, sole proprietorships offer no protection to the owner from liabilities.

In South Carolina, there is no need to file documents with the state to form a sole proprietorship.

2. Partnership.

A partnership is a sole proprietorship owned by two or more people. The two partners share profits, losses, liability, and responsibility. A general partnership usually revolves around a partnership agreement. In South Carolina, there is no need to file any formation documents to create a partnership.

If the business will be operating under a name other than one of the partners' last names, the name must be registered with the Secretary of State.

There are two other kinds of partnerships in South Carolina.

Limited Partnership.

A limited partnership is a partnership wherein one partner is fully liable for the business's debts and obligations and is responsible for the running of the business, and the other has limited liability. The limited partner is like a shareholder in a corporation who has little say in the running of the business and can't be held personally liable for any debts or obligations.

In South Carolina, limited partnerships are created by filing a Certificate of Limited Partnership with the Secretary of State. Limited partnership business names must include "LP." For example, "Green Machine, LP."

Limited Liability Partnership.

A limited liability partnership offers protection against liability to all the partners. In South Carolina, a limited liability partnership needs to be registered with the Secretary of State by completing an Application for Registration. In order to continue doing business in South Carolina, limited liability partnerships must renew their registrations every year.

Limited liability partnership business names must include "LLP." For example, "Golden Crops, LLP."

3. Limited Liability Company.

A Limited Liability Company (LLC) has the characteristics of a corporation and partnership. It is held separate from its members financially and the members can decide whether they should be taxed personally or the LLC should be taxed like a corporation. To form an LLC you must file articles of organization with the South Carolina Secretary of State.

LLC business names must include "LLC," or "Limited Liability Company." For example, "Buzz World, LLC."

4. Corporation.

Corporations are usually owned by several shareholders and are treated as separate, single entities. Corporations can sell stocks. Shareholders have little say in running corporations but appoint directors to do so. Incorporating protects personal assets.

Corporations are created in South Carolina by filing articles of incorporation with the Secretary of State. Before filing articles of incorporation, all businesses are required by state law to have them reviewed and signed by licensed attorneys first.

There are four kinds of corporations in South Carolina.

C Corporation.

A corporation may elect to be a C Corporation and accept double taxation. The corporation is taxed on income and the shareholders are taxed on their share of profits. When you register a corporation, it is automatically a C Corporation.

S Corporation.

An S Corporation is a corporation that isn't taxed twice. Only the shareholders are taxed on their incomes. To create an S Corporation in South Carolina, a corporation must file IRS Form 2553, Election by a Small Business Corporation.

Professional Corporation.

Professional corporations are corporations formed by licensed professionals. In this way, all the shareholders are protected from any malpractice of other shareholders.

Nonprofit Corporation.

A nonprofit corporation always puts income back into its various operations and never pays profit shares to shareholders. These types of corporations are tax-exempt.

How to Start a Business in North Carolina

South Carolina Registration and Filing Fees:

Fee Type | Cost |

|---|---|

Articles of Incorporation for a Professional Corporation | $110.00 |

Application to Reserve Corporate Name | $10.00 |

Articles of Incorporation for a Nonprofit Corporation | $25.00 |

Articles of Organization | $110.00 |

Application for Registration of a Limited Liability Partnership | $100.00 |

Certificate of Limited Partnership | $10.00 |