How to Start a Business in Oregon Checklist

Download our free checklist for starting a business in Oregon, in PDF format.

Download NowHow to Start a Business in Oregon:

Oregon offers generous tax rates for small businesses and there are very few registration requirements to start a business. All forms, permit applications, and tax returns can be filed easily with their high-quality Secretary of State website.

Form your business.

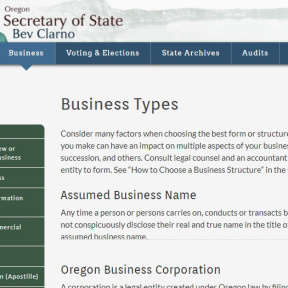

Review Oregon formation options.

Oregon offers 4 ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

When you have a name idea in mind, search the Business Registry Database to see if the name has already been registered. You should also search the USPTO Trademark Database to see if your business name has been trademarked.

If you need help finding a business name, be sure to check out our free business name generator.

Once you have navigated to the Business Registry Database, select "Business Name Availability Check" under search methods and enter your name idea.

The Oregon business registry is the Secretary of State's list of registered businesses within the state. You can search this registry on the SOS website to find information about registered businesses and to check if your preferred name for your new business has not already been registered.

Read through the search results and make note of names that are similar to yours in a way that may be confusing.

Look at the "Entity Status" column to see if a business is active (ACT) or inactive (INT). Business names for inactive businesses may be available.

The easiest way is to register your business name is on the U.S. Patent and Trademark Office website. Prior to registration, remember to check on the Trademark Electronic Search System and the Oregon Business Registry to ensure that your business name is not already registered by another company.

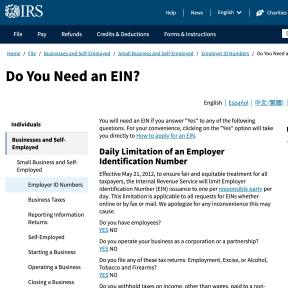

Get an Employer Identification Number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

Register your business.

All business applications can be submitted online with the Secretary of State.

To register as a corporation you will need to file Articles of Incorporation with the Secretary of State.

To register as an LLC you need to file Articles of Organization with the Secretary of State.

Both a partnership and a sole proprietorship only require owners to file an Assumed Business Name form with the Secretary of State.

It costs $100.00 to file as an LLC, corporation, or partnership.

Obtain necessary permits and licenses.

The state of Oregon does not offer a general business license, but there are industry-specific licenses and permits that businesses will need to apply for. You can search the license directory with keywords related to your business to find out which licenses are required.

Contact your local county to find out which local permits are required. In general, your business location needs to be in the correct zone to operate. Contact the city or county planning office to find out if you are allowed to conduct business from your location.

Register your business for taxes.

Register for corporation excise tax.

If you are registered as a C corporation or registered as an LLC that elects to file taxes as a corporation, you will need to pay corporation excise tax.

The other business types in Oregon are not required to pay business income tax, as money is passed through the owner directly and the owner pays individual income tax.

The Oregon Department of Revenue has created a detailed guide to filing your corporation excise tax. The guide takes tax players line by line to explain the information required.

Register for corporate activity tax.

Corporate activity tax applies to businesses in Oregon with commercial activity in excess of $1 million.

You can register for corporate activity tax online.

Hire employees and report them to the state.

Get workers' compensation insurance.

All employers in Oregon are compelled to provide workers’ compensation coverage to their employees. You can purchase insurance from any accredited insurance provider.

Health insurance isn’t a requirement for small businesses in Oregon.

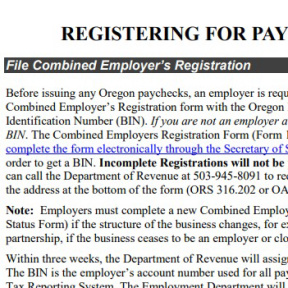

File Combined Employer’s Registration.

You need to file a Combined Employer's Registration form before you can pay Oregon Employees. You can do this online.

After completing and submitting your form, you will be issued a Business Identification Number (BIN).

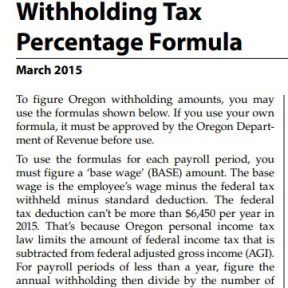

Withhold tax from employee wages.

As an employer, you are required to withhold income tax. You can calculate how much tax to withhold by using the Oregon Department of Revenue withholding tax percentage formula.

Filing for withholding taxes is facilitated by the Combined Employer's Registration form.

Pay unemployment insurance tax.

Use the Combined Employer's Registration form to file for unemployment insurance tax. Limited liability companies are excluded from paying unemployment insurance tax.

Register for transit district taxes.

Employers who pay wages for services provided in the TriMet or LTD districts need to pay transit district taxes. This tax can be registered for using the Combined Employer's Registration form.

Have employees complete form I-9.

Ask employees to complete form I-9 to verify that they are eligible to work in the U.S. Employers keep these forms on record.

Oregon Business Types:

1. Corporation.

A corporation is owned by shareholders who elect a board of directors to make major decisions for the business. The board hires officers to perform day-to-day operations and run the business. To form a corporation you must file Articles of Incorporation with the Secretary of State.

Some benefits of incorporating include being able to sell shares in the company, easily changing ownership, and shareholders having no personal liability for debts. The setback of incorporating is double taxation, as income as well as shareholder dividends are taxed.

2. Sole Proprietorship.

A sole proprietorship is usually formed by an individual and the business operates under their name unless they file an Assumed Business Name form. All income is taxed as individual income, and the owner assumes all debt and liability.

3. Partnership.

A partnership is formed by two or more partners. There are two types of partnerships: Limited Liability Partnership and Limited Partnership.

Limited Liability Partnership: In a Limited Liability Partnership, each partner is only liable for themself. This business type is limited to professional partners such as lawyers or doctors who may be sued for misconduct or malpractice.

Limited Partnership: A Limited Partnership is made up of one general partner and additional limited partners. The general partner is responsible for managing the business and assumes liability for the business.

4. Limited Liability Company:

A Limited Liability Company (LLC) is formed by at least one member who is also the owner. An LLC removes personal liability from the owners. To form an LLC, you need to file Articles of Organization.

An LLC is taxed either as a corporation or as a partnership.

Oregon Business Filing Fees:

Filing Type | Cost |

|---|---|

Assumed Business Name Registration | $50.00 |

Certificate of Limited Partnership | $100.00 |

Articles of Organization for LLC | $100.00 |

Articles of Incorporation for Domestic Corporations | $100.00 |

Application for Registration for LLP | $100.00 |