How to Start a Business in Oklahoma — Checklist

Download our free checklist in PDF format to help keep you on track when starting your business in Oklahoma.

Download NowHow to Start a Business in Oklahoma:

Oklahoma sits in the top ten states for entrepreneurship, startup early job growth, and venture capital investment. Known for its energy, information technology, and agriculture industries, the Sooner State is a great destination to start a small business. Follow these steps when starting your business in Oklahoma.

Form your business.

Review Oklahoma formation options.

Oklahoma offers four ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

There are also special versions of some legal structures available including limited partnerships, general partnerships, C corporations, and S corporations.

Businesses are regulated by Oklahoma state laws and must be registered through the Oklahoma Secretary of State website.

Name your business.

To secure your business name, you will need to register it with the Oklahoma Secretary of State. However, before you are able to register your name, you will need to check that your business name is different from other business names already on file with the Oklahoma SOS.

Go to the Oklahoma Secretary of State website.

Select the "Business Services" tab.

Select "Name Availability" under the "Search" column.

Enter your proposed name in the search box.

Click on "Search."

Read through the search results for businesses that match your search or closely related names. Click on the filing number to read more about each registered business.

You may register your business in person, by mail or electronically via the SOS website. Depending on your business structure, you may need to file Articles of Incorporation or a Fictitious Name Registration.

For LLCs and corporations, you can check for available business names by performing a business entity search. Available names can be reserved for 60 days by filing a Name Reservation Form with the SOS. There is a $10.00 filing fee.

Furthermore, to avoid trademark infringement, you should do a federal and state trademark search with the U.S. Patent and Trademark Office (USPTO).

If you need help finding a business name, be sure to check out our free business name generator.

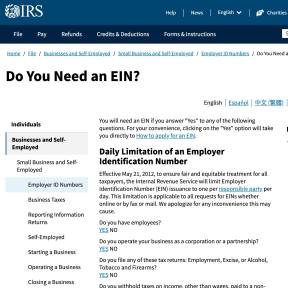

Get an Employer Identification Number (EIN).

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

If your business is taxed separately from you or requires employees, you will need to obtain a federal Employer Identification Number (EIN). You can complete an online application on the IRS website. There is no filing fee and you'll receive your EIN via email within 24 hours.

The application must be finished in one session. You will not be allowed to save or return.

Register your business in Oklahoma.

Once you have chosen a business name and a legal structure, you can then register your business with the state.

Go to the Oklahoma Secretary of State's Downloadable Business Forms page.

Click on the link that corresponds to your business formation type.

Once your application has been reviewed and processed, you will receive a mail or email informing you of the approval or rejection of your application.

Obtain necessary permits and licenses.

In Oklahoma, there is no generic license required to own or do business. However, many businesses, business owners and/or their employees, may require special licenses and permits to legally operate in the state. Depending on your business, some permits are may be issued by a city or local government.

To find out about the different licenses and permits issued by the state, visit the Business Licensing & Operating Requirements section of the Oklahoma Department of Commerce website.

Businesses that employ professionals may also require additional licenses and permits. These cover various industries and businesses. Search the Professional License Online Services section on the state government website for more details.

Restaurants and bars in Oklahoma need to have a Alcoholic Beverage License.

Laundromats in Oklahoma need to have a Dry Cleaning License.

Advertising agencies in Oklahoma need to have an Advertising License.

Register your business for taxes.

Obtain a sales tax permit.

In Oklahoma, sales tax permits are required for retailers, resellers, or others that sell tangible goods on a continuous basis. You can obtain a sales tax permit from the Oklahoma Tax Commission.

If your business has employees, you will need to apply for employer withholding tax.

Register online by using the Oklahoma Online Business Registration System. There is no filing fee.

Pay franchise tax.

Oklahoma is one of 12 states that are required to pay franchise tax. Franchise has little to do with owning a franchise and is simply a tax imposed for having a physical presence in Oklahoma.

Oklahoma businesses pay a rate of $1.25 per $1,000 of capital. This is only applicable to corporations exceeding $201,000 of capital, and LLCs are exempt.

File your balance sheet.

File schedules B, C & D of your annual return.

State the value of your business's life insurance, franchises, and intellectual property assets.

File your Oklahoma Annual Franchise Tax Return and include your FEIN.

Fill out Schedule A.

State the names and contact information for the business's officers.

Oklahoma Franchise Tax should be paid by July 1, unless a Franchise Election Form (Form 200-F) has been filed. The tax will be delinquent if not paid before September 15.

There is a 10% penalty plus 1.25% interest per month for payments after the due date.

Hire employees and report them to the state.

Register new employees with the Oklahoma Employment Security Commission.

Under Oklahoma law, all employers must report certain information on their newly-hired or re-hired employees to the Oklahoma Employment Security Commission (OESC). The reporting process needs to be done within 20 days of employment.

For quick and efficient reporting, you can use the online portal. You will need to create an account to access the online services. You can also report employees by fax or by mail. Simply download the form and follow the mailing information at the top of the form.

Go to the Oklahoma Employment Security Commission online portal.

Select "First Time User."

Enter your email you would like to register with and follow the prompts.

Obtain Workers' Compensation Insurance.

Oklahoma business owners with one or more employees are obligated to carry workers' compensation insurance. For more comprehensive information about exemptions, visit the State of Oklahoma Workers' Compensation Court.

In addition, it's mandatory to have a minimum automobile insurance for your business drivers. If your business uses your personal truck or car, a commercial vehicle policy is recommended.

Oklahoma Business Types:

1. Sole proprietorship.

Sole proprietorships are the simplest way to start a business in Oklahoma. Sole proprietorships offer ease of formation and complete ownership. Only form a sole proprietorship when you know all the risks associated with your business, as you are personally liable for business losses.

Oklahoman sole proprietors can be established without filing any legal documents. If, however, you decide to operate under a name other than your legal name, you will be required to submit a trade name report with the Oklahoma Secretary of State. Your name must be checked against a trademarked database. If you employ anyone under your sole proprietorship, you will have to obtain an EIN number and register for taxes through the Oklahoma Tax Commission.

2. Partnership.

Forming a general partnership in Oklahoma is a straightforward process. Partnerships are ideal if your business partner can bring capital and expertise to the table that you cannot. The profits and risks are shared equally among partners and you don't pay business tax.

Oklahoman partnerships are taxed as pass-through entities, which means the only payable tax is your personal income tax. Oklahoma offers the full range of partnership forms, including general partnerships, limited partnerships, limited liability partnerships, and limited liability limited partnerships. Like with sole proprietors, partnerships only have to register their business name, file paperwork, and register for taxes if they operate under a fictitious name or employ workers in their partnership.

In Oklahoma, a partnership also must file a Trade Name Report with the SOS if their business name doesn't include the owner/s name or surname. There is a $25.00 filing fee.

3. Corporation.

Registering as a corporation in Oklahoma is more costly and takes longer, but the benefits are clear. Corporations allow you dip into a wider capital pool and affords you protection of personal assets in the event of a business failure. Corporations need to pay business tax.

Incorporating in Oklahoma starts with filing a certificate of incorporation that includes your corporation name, purpose, stock structure, incorporator names and addresses, the names and addresses of directors, and your registered agent and office.

Finally, in Oklahoma, corporations are also subject to corporate income tax and corporation franchise tax. Income tax returns are due on the 15th day of the fourth month after the end of the tax year.

4. Limited liability company (LLC).

Incorporate as an LLC in Oklahoma if you operate in a high-risk industry and you want more power over the operational activity of your company. LLCs afford you better profit distribution among members as well as limited ownership restrictions.

An LLC is a common choice for small business owners because of its minimal paperwork, flexibility, tax benefits, and simple implementation process. LLC business owners are not obligated to file a corporate tax return. You can set up an LLC in Oklahoma for $100.00. In order to register your LLC, you must file the Articles of Organization with the State of Oklahoma. You can file online, by mail, or in person. The filing costs $100.00, and this process can take up to seven days, depending on which method of filing you choose.

A list of downloadable business forms can be found on the Oklahoma SoS website.

Fees for Registering a Business in Oklahoma:

Fee Type | Cost |

|---|---|

Name Registration | $10.00-$25.00 |

Annual Reports | $25.00 |

Filing Articles of Organization | $100.00 |

How to Start a Business in New Mexico