How to Start a Business in NC Checklist:

Download our free checklist in PDF format to help you stay on track with starting your business in North Carolina.

Download NowHow to Start a Business in North Carolina:

North Carolina offers a simple, efficient process for starting a business, with useful checklists provided by the NC Secretary of State and Department of Revenue. Each business must find out its own specific licensing requirements, but can register for all their tax requirements on one simple platform.

Form your business.

Review North Carolina formation options.

North Carolina offers 4 ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

Once you choose a name for your business, you will need to check its availability. If your chosen name is not currently being used by another business in North Carolina, you can file an Assumed Business Name Certificate.

If you need help finding a business name, be sure to check out our free business name generator.

Do an online search using a variety of search engines, such as Google, Bing, and Yahoo, and also search the North Carolina Secretary of State's business database to check that your chosen name is available.

Visit the North Carolina Secretary of State website and download the assumed business name form. Carefully read the instructions before completing the form.

File the completed form with the Register of Deeds in the county in which your business is based, along with a filing fee of $26.

You can find your Register of Deeds on the North Carolina Association of Registers of Deeds website.

Assumed Name Certificates filed in North Carolina do not expire and do not require renewal.

Think about registering a trademark. The filing fee for an application to register a trademark or service mark in North Carolina is $75. Visit the Secretary of State website to get the application form and filing instructions.

Once you have found a suitable name, make sure to register the matching web domain and social media handles, should you wish to market your business online.

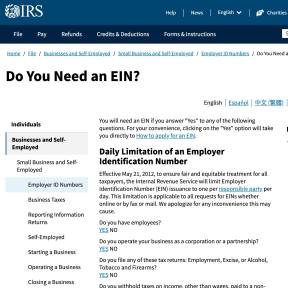

Get an Employer Identification Number.

Nearly all businesses will need to register for federal taxes by applying for an Employer Identification Number.

Register your business in North Carolina.

Register your business with the correct office.

If you are starting a sole proprietorship or general partnership and you decide to use a business name other than your own name, you must file an Assumed Business Name Certificate with your County Register of Deeds.

If you are starting a profit or nonprofit corporation, limited partnership, or LLC, you must register your business with the NC Secretary of State's office.

Business Link North Carolina is a free service offered to anyone seeking to start a small business in North Carolina and who operates in partnership with the North Carolina Department of Commerce. They provide assistance and resources to business owners regarding business registration, business licenses, tax requirements, business plans, and access to capital.

For sole proprietorships and general partnerships: Navigate to edpnc.com and download an Assumed Business Name Certificate.

Fill out the form with the assumed name, the owner's name, business type and address, and the names of the NC counties where the business will operate under the assumed name.

Deliver your Assumed Business Name Certificate in person to your County Register of Deeds office and pay the fee, if required.

You can find your County Register of Deeds office address on the NC Association of Registers of Deeds' website.

For corporations, limited partnerships, and LLCs: Go to the SOS website and click on "Forms" and then "Business Registration" to start the process.

Download the appropriate form first by clicking on the link in the table at the bottom of the page. Click on "Get Started" under the type of business entity you want to start for instructions on what must be included in your application.

Corporations must file Articles of Incorporation, LLCs must file Articles of Organization, and limited partnerships must file a Certificate of Registration.

Return to the SOS website and click on "Forms" and then "Business Registration" to find your specific forms.

Select your filing options, whether you wish to file online, via mail, in person, or expediate your documents, and click "Get Started."

Follow the instructions for submitting your applications. The online submission option has seven distinct steps that you must complete. You will need to return to the instruction page to move on to the next step each time.

Obtain the necessary permits and licenses.

The state of North Carolina does not have any single generic business license that ensures compliance with all requirements. Your business may, however, require a specific license, permit, certification, or occupational license depending on the type of business that you open.

North Carolina's Business and Occupational License Database is an excellent resource for learning more about the licenses and permits you will need. Search for your business type in their list and click on the link to view your requirements.

You will also need to contact your local city, county, or municipality for information on environmental permits and zoning requirements.

There are various costs associated with businesses obtaining filings and trademarks necessary for their business to operate legally in North Carolina. You can contact Business Link North Carolina for specific information regarding your business.

Register your business for taxes.

Register for state taxes.

Businesses in North Carolina must register to pay state taxes, which includes sales and use tax, income tax withholdings, and other taxes and service charges.

Businesses in North Carolina do not need to pre-register to pay state income taxes. Sole proprietorships use their social security, partnerships and corporations use their federal identification numbers, and LLCs are taxed either as corporations or as partnerships.

Use this checklist to make sure you have all the necessary information to complete your tax registration.

Go to the NC Department of Revenue website and click on the tax type relevant to your industry.

Download the required forms or just click on "Next."

Fill out the form and submit your answers.

List your business personal property for county property taxes.

Business owners are responsible for listing their business personal property with the County Tax Assessor's office.

Mail your business listing to your County Tax Assessor's office, c/o Property Tax Business Listing. Do not fax your business listing as it will not be accepted.

Register for unemployment tax.

The North Carolina unemployment insurance program is designed to provide temporary economic benefits to eligible workers. To determine the extent of your obligation, contact your local Division of Employment Security Job Service Center.

Register for franchise and income tax.

A franchise tax is imposed on corporations for the privilege of doing business in North Carolina. This tax is due annually as long as the corporation remains incorporated, domesticated or continues to do business in the state.

You can find links and information on all the required North Carolina taxes on the Department of Revenue's website.

Hire employees.

Report all newly hired and rehired employees.

In compliance with federal and state laws, all newly hired and rehired employees, as well as employees who have been terminated, must be reported to the NC Directory of New Hires.

The Immigration Reform and Control Act of 1986 requires employers to verify employment eligibility by completing and retaining a one-page Employment Eligibility Form (Form I-9).

The North Carolina Wage and Hour Act (WHA) does not require mandatory meal breaks or rest breaks for employees 16 years of age or older, but does require meal breaks and rest breaks of at least 30 minutes after five hours for those workers under the age of 16 years old. The rule applies to businesses reporting gross receipts of under $500,000 and to nonprofit organizations.

Register your business online on the Directory of New Hires' website.

Enter your company information, including EIN, company address for income withholding orders, and your contact information, and create a password.

With your new account, you can use online reporting with the Directory of New Hires' file format to report your new hires.

Another way to report your new hires is to download the new hire form in PDF, fill it out, and mail or fax it to the New Hire Reporting Center.

Register for employee income tax withholding.

Businesses that have employees must register for employee income tax withholding on the North Carolina Department of Revenue's website.

Navigate to the Withholding Tax Forms and Instructions page.

Scroll down to form NC-BR and click "Register Online."

Make sure you have all the necessary information, including your EIN and SOS Number, business information, and the details of all responsible partners (if applicable) before clicking on the "Online Business Registration" button.

Click "next" at the bottom of the page and fill out the electronic registration form.

You will receive a withholding tax account number which should be used on all of your reports and correspondence that concern withholding tax.

Get workers' compensation and unemployment insurance.

The North Carolina Industrial Commission administers the Workers’ Compensation Act. It requires any employer with three or more employees to provide workers’ compensation coverage. Any sole proprietor or partner of a business whose employees are eligible for benefits may also be covered as an employee.

Unemployment insurance is handled by the Division of Employment Security.

Health insurance isn’t a requirement for small businesses in North Carolina.

Put up mandatory posters and notices.

The North Carolina Employee Fair Classification Act states that employers must post a notice in the workplace stating that workers will be treated as employees unless they are independent contractors and that those who believe they have been misclassified have the right to report the alleged misclassification to the Employee Classification Section.

All mandatory posters can be downloaded for free from the Department of Labor website.

North Carolina Business Types:

1. Sole proprietorship.

A North Carolina sole proprietorship is the simplest business structure and is owned and operated by a single individual. The owner is responsible for all the profits and losses of the business and is personally and legally liable for the business. Sole proprietorships should file a Certificate of Assumed Name with the County Register of Deeds.

2. General Partnership.

General partnerships are suitable for businesses with two or more owners who contribute money, labor, and skill to the business. The partners share profits and losses, as well as the management of the business, and are legally liable for the business.

General partnerships should file a Certificate of Assumed Name with the County Register of Deeds. However, limited partnerships, limited liability partnerships, and limited liability limited partnerships should file a Certificate of Registration with the Secretary of State's office.

3. Corporation.

Corporations are standalone, separate entities that protect the owners from personal liabilities. Corporations generally have shareholders who can buy and sell stock in the company. Corporations must file Articles of Incorporation with the North Carolina Secretary of State.

4. Limited Liability Company (LLC).

LLCs are legally separate from their owners and are the most popular business type because of minimal paperwork, flexibility, tax benefits, and a simple implementation process. LLCs offer business owners limited liability and prevention of double taxation. LLC business owners are not obligated to file a corporate tax return.

LLCs are regulated by North Carolina state laws and must be created by filing the Articles of Organization with the Secretary of State for North Carolina. LLC costs start from as little as $125.00 and can be registered online or by mail.

How to Start a Business in South Carolina

North Carolina Formation and Registration Fees:

Fee Type | Cost |

|---|---|

Articles of Organization | $125.00 |

Articles of Incorporation for a Business Corporation | $125.00 |

Articles of Incorporation for a Nonprofit Corporation | $60.00 |

Application for Registration of a Limited Liability Partnership | $125.00 |

Certificate of Domestic Limited Partnership | $50.00 |

Certificate of Registration for a Limited Liability Limited Partnership | $125.00 |

Application to Reserve a Business Entity Name | $30.00 |

Articles of Merger | $50.00 |