New Hampshire Business Checklist:

Download this useful business checklist in PDF format to start your business in New Hampshire.

Download NowHow to Start a Business in New Hampshire:

New Hampshire is in close proximity to Boston and its many business opportunities. Forming a business is more affordable than in most states, and while the labor force is fairly small, it is highly skilled and educated. It is a good time to consider starting a business in the Granite State as it has made many resources available in its drive to attract new businesses. Here's how to get started.

Form your business.

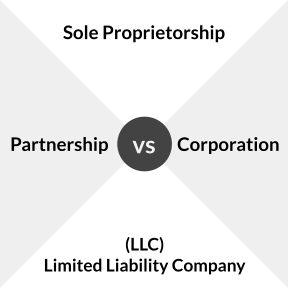

Review New Hampshire formation options.

New Hampshire offers 6 ways of forming your business, which we'll cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

Business names in New Hampshire must be registered with the Secretary of State's Office. Business names must be distinguishable from others and must contain certain elements depending on the structure of the business. The New Hampshire Department of State has a Name Availability Guideline that is worth taking a look at before starting the process of naming your business.

If you need help finding a business name, be sure to check out NameSnack's free business name generator.

Use the NH QuickStart tool to check existing business names and trademarks.

Fill in the business name.

Enter the Captcha Text.

Create a free NH QuickStart account.

Go to the login page.

Click "Create a free account."

From the menu, click "Business Service," then "Create a business online," and the "trade name."

Or, download the Application for Registration of Trade Name form on the Secretary of State's Forms and Fees page and mail it to the Corporation Division of the Secretary of State.

Pay the registration fee of $50.00.

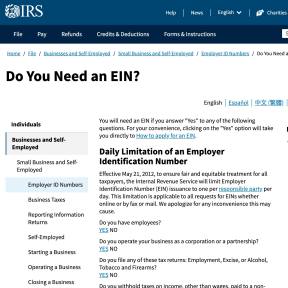

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

Register your business in New Hampshire.

In New Hampshire, sole proprietorships do not need to file any formation documents with the state, unless they intend to operate under a name other than that of their owner. Partnerships, however, need to register by filing their partnership agreement. To form a corporation, limited liability company, or limited partnership you need to file specific documents with the New Hampshire Secretary of State's Office. This can be done online. The cost of formation depends on the structure of the business.

To register a corporation you need to file Articles of Incorporation. This can be done through the NH QuickStart tool. There is a fee of $100.00.

To register an LLC you need to file a Certificate of Formation. You can do this through the NH QuickStart online tool. It costs $100.00.

To register a limited partnership you need to file a Certificate of New Hampshire Limited Partnership. It can be done online using NH QuickStart. It costs $100.00.

To register a limited liability partnership you need to complete and submit registration form LLP-1. This can be done online using the NH QuickStart portal. It costs $100.00.

Create an NH QuickStart account.

Provide your personal information, addresses, contact details, etc.

Enter your preferred login details.

Complete the registration.

Login to your NH QuickStart account.

Click "Business Services."

Click "Create a Business Online."

Obtain necessary permits and licenses.

Check the New Hampshire government Online Licensing webpage to see if your business will need any professional licenses or permits. To apply for a license, create a New Hampshire Online Licensing Account.

Common licenses include:

- Architect Business.

- Body Art.

- Chiropractor.

- Dietitian.

- Engineering Business.

- Land Surveyor Business.

- Massage Therapy.

Register your business for taxes.

Register for corporate income tax.

All businesses with annual revenues greater than $50,000.00 must register for New Hampshire corporate income tax, also known as the Business Profits Tax. Eligible businesses are taxed 7.7% of revenues and must file annual returns.

Register your business with the NH Secretary of State's Office, Corporate Division.

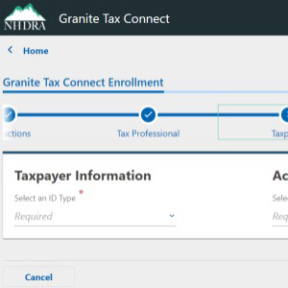

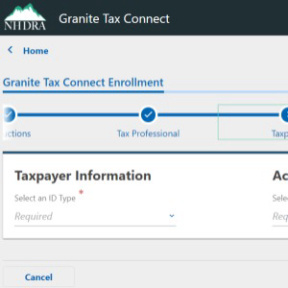

Use the new Granite Tax Connect.

Or, write a letter and send it to the NH Secretary of State's Office, Corporate Division, 107 N. Main Street, Concord, NH 03301-4989.

Or, call: 1 (603) 271-3246.

Register for Business Enterprise Tax.

All businesses with annual gross receipts greater than $217,000.00 must register for the Business Enterprise Tax, and file annual returns. The BET tax rate is 0.60%.

Register your business with the NH Secretary of State's Office, Corporate Division.

Use the new Granite Tax Connect.

Or, write a letter and send it to the NH Secretary of State's Office, Corporate Division, 107 N. Main Street, Concord, NH 03301-4989.

Or, call: (603) 271-3246.

Register for unemployment compensation tax.

Employers in New Hampshire must pay the state's Unemployment Compensation Tax. The tax rate is 1.7% of the first $14,000 of an employee's wages. Tax reports need to be filed every quarter.

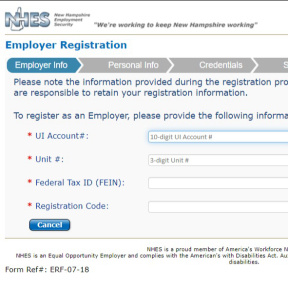

Register an account with the NH Employment Security's Unemployment Compensation Bureau.

Go to the Employer Registration tool.

Submit federal tax information.

Submit your personal information.

Provide the required credentials.

Set security questions.

Complete the registration.

Hire employees and report them to the state.

Purchase workers' compensation insurance.

All employers in New Hampshire must have workers' compensation insurance before they start employing people. This is to ensure that employees are financially supported in the event of injury or loss of employment due to a workplace accident.

Your insurance provider will issue you with a notice of compliance, Form No. WCP-1. It is a poster containing basic information including the name of the insurer.

Hang this poster up in the workplace where it can easily be seen.

Report new hires to the New Hampshire Employment Security Bureau.

All businesses that employ people are required by law to provide certain information about employees to the NHES. In New Hampshire, you need to report new hires, rehires, and independent contractors you pay within 20 days of the hire. You can do this online.

Go to the New Hampshire Employment Security home page.

Click on the dark blue "Employer WEBTAX and New Hire Reporting" tab.

Click "Login to existing account."

Accept the terms and conditions.

Login using your user ID and password.

Complete the online New Hire Reporting Form.

New Hampshire Business Types:

1. Sole Proprietorship.

Sole proprietorships are small businesses with a single owner who is responsible for the business's operations and finances. They are financially liable for the business's debts, obligations, and liabilities. Sole proprietorships pay personal income tax on business profits.

2. Partnership.

A partnership has the same characteristics as a sole proprietorship only the liability and responsibility are shared between two or more people. The nature of the partnership is usually defined by a partnership agreement, which needs to be filed with the New Hampshire Secretary of State.

3. Corporation.

Corporations are usually larger businesses owned by several shareholders but are treated as separate entities. Shareholders play a limited role in running corporations but appoint directors to manage them. Each shareholder is liable for the business's debts and obligations only to the extent of their investment. Corporations in New Hampshire are taxed 7.7% of revenue.

Corporations are created in New Hampshire by filing Articles of Incorporation with the Secretary of State.

4. Limited Liability Company.

A limited liability company (LLC) is a type of entity that has the characteristics of a corporation and partnership. It is held separate from its members financially and it allows corporate taxes to pass through to the members as personal income tax.

An LLC requires that you file a Certificate of Formation with the New Hampshire Secretary of State.

5. Limited Partnership.

A limited partnership is a partnership wherein one partner is fully liable for the business's debts and obligations, and the other has limited liability. The structure is also different in that the partner with limited liability often has no management powers.

In New Hampshire, Limited Partnerships are created by filing a Certificate of Limited Partnership with the New Hampshire Secretary of State.

6. Limited Liability Partnership:

A limited liability partnership is a limited partnership offering limited liability to all the partners. In New Hampshire, a limited liability partnership needs to be registered with the Secretary of State by completing Form LLP-1.

New Hampshire Business Formation Fees:

Fee Type | Cost |

|---|---|

Name Registration | $15.00 |

Corporation | $100.00 |

Nonprofit Corporation | $25.00 |

Limited Liability Company | $100.00 |

Limited Partnership | $100.00 |

Limited Liability Partnership Registration | $100.00 |