How to Start a Business in Michigan Checklist:

Download this free business checklist in PDF format.

Download NowHow to Start a Business in Michigan:

It is fairly easy to register a business in the state, and there are several business resources, such as the Small Business Association of Michigan (SBAM), aimed at helping small business owners prosper.

Form your business.

Review Michigan formation options.

Michigan offers six ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

The cost of filing Articles of Incorporation is $10.00 plus an additional fee of between $50.00 and $500.00, depending on the number of authorized shares you have. A Certificate of Assumed Name costs $10.00.

The Small Business Administration defines a small business as a firm that has less than 500 employees.

Name your business.

Once you have chosen a name for your business, you will need to check that it is not already in use by performing a name search on the U.S. Patent and Trademark Office website and the Michigan Corporations Name Availability Search portal.

In Michigan, your business name will be registered at the same time your legal entity is formed, unless you are using your personal name, in which case you do not have to file a name registration.

If you need help finding a business name, be sure to check out our free business name generator.

To reserve a name, you can file an Application for Reservation of Name online, by mail, or in person. Business owners are able to reserve a name for 6 months.

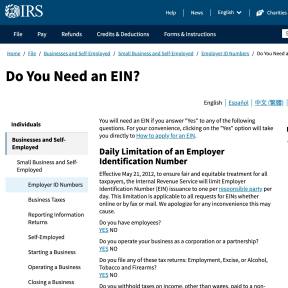

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

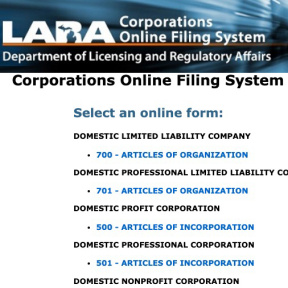

Register your business in Michigan.

If you are establishing a sole proprietorship and are assuming a different name, you will need to file a "Doing Business As" (DBA) certificate with the county clerk in the county in which you plan to do business. You can find a list of counties online.

For all other legal structures, you will need to appoint a registered agent and file Articles of Organization via mail, in person, or online via the Corporations Division of the Michigan Department of Licensing and Regulatory Affairs (LARA).

All business formation forms can be found here. The filing cost is $10.00 plus an additional fee of between $50.00 and $500.00, depending on the number of authorized shares you have.

Create an account on the Corporations Online Filing System. You will be provided with a Customer ID Number (CID) and pin.

Sign in and select the applicable Articles of Organization.

Enter all the required information.

You will then be prompted to sign the document, insert your title, and add additional signatures.

Click the "Review" button to ensure all your information is correct.

If you are satisfied, click "Submit Filing."

You will then be prompted to pay the filing fee via credit card.

Once your credit card has been processed, you will receive an acknowledgement message on-screen, which you may print for future reference.

Once the transaction is complete, your document will be sent to the Corporations Division for review.

It takes 5–10 business days for your LLC to be approved.

Obtain necessary permits and licenses.

There is no general business license in Michigan. However, depending on your type of business, you may need to acquire one or more licenses/permits to operate in your city or county.

To find out if your business requires a license/permit, perform a search on the State License Search webpage. Here are a few businesses that require a license/permit to operate.

Local licensing, permits, and regulations may differ from the state's. Be sure to check with your county or city clerk to determine licensing requirements in your area.

Note that some municipalities require a license for home-based businesses.

You can apply for the licenses and permits that you need to do business in Michigan via michigan.gov. To get information about professional and occupational licenses, go to the Bureau of Professional Licensing site.

Register your business for taxes.

Register for state taxes.

All new businesses must register for taxes via the Michigan Treasury Online (MTO) site. The MTO site allows you to register for all business taxes quickly and efficiently.

Start off by creating a personal user profile. If your business has an EIN, this will be your Treasury business account number.

On the MTO home page, log in to your profile and select "Start a New Business (E-Registration)." Then fill out the application form.

Your application should be recognized on the Treasury’s system within 15 minutes. However, it can take up to 48 hours to process an electronic application.

Register for Income Withholding tax.

Every employer who is required to withhold federal income tax under the Internal Revenue Code must be registered for and withhold Michigan income tax. The withholding rate for 2023 is 4.25% with a personal exemption of $4,400.

Register for Sales and Use tax.

All businesses that sell tangible goods or lease tangible personal property require a Sales or Use tax license. This includes retailers, wholesalers, contractors, services, and out-of-state sellers. The sales tax rate for 2023 is 6%.

Register for Michigan Business Tax (MBT).

If your business earns in excess of $350,000 a year, you will need to register for MBT tax. The current tax rate is 4.95%.

Register for Corporate Income Tax (CIT).

Michigan imposes a 6% CIT tax on C-corporations that make in excess of $350,000 a year. The CIT includes a small business alternative credit with a reduced tax rate of 1.8% of adjusted business income.

There are additional state taxes for motor fuel, tobacco, severance (oil and gas severed from the soil), state real estate transfers, and the sale of marijuana. For more information, visit the Michigan Department of Treasury.

Hire Employees and Report them to the State.

Go to the Michigan New Hires Operation Center.

All employers are required to report new employees to the state within 20 days of being hired.

Obtain Workers' Compensation Insurance.

Businesses must have workers' compensation insurance if they employed one or more people for 35 hours or more per week for 13 weeks or longer during the preceding year.

Display mandatory posters in your place of business.

Business owners can obtain the mandatory business posters from LARA or from the U.S. Department of Labor.

Michigan Business Filing Fees:

Filing Type | Cost |

|---|---|

Name Reservation | $10.00 |

Certificate of Assumed Name | $10.00 |

Articles of Incorporation (For Profit) | $10.00 + $50.00 – $500.00 (depending on no. of shares) |

Annual Report | $25.00 |

Michigan Business Types:

1. Sole Proprietorship.

A Sole Proprietorship is the simplest business structure. The business is owned and operated by one individual who is personally liable for all the debts of the business. It is relatively easy and inexpensive to form.

2. Corporation.

A Corporation is a very formal business structure with unlimited shareholders. The business is authorized to act as a single entity and is recognized as such in law. In Michigan, a corporation must have at least one director.

3. Limited Liability Company.

A Limited Liability Company (LLC) is the most common business structure. It can be formed by an individual who may, but need not be a member. An LLC separates the owner/s and the company from a business and liability perspective. It is the best option for a small business as it is flexible, easy to set up, and requires minimal paperwork.

4. General Partnership.

In Michigan, a General Partnership (GP) must have at least one general partner and one limited partner. In a GP, the partners split profits evenly and share liability. This is the simplest form of a partnership with minimal paperwork.

5. Limited Partnership.

A Limited Partnership (LP) is similar to a General Partnership. However, general partners manage the day-to-day operations of the firm and are liable for the debts of the business, while limited partners do not manage the business and are only liable for the funds they've invested in the company.

6. Limited Liability Partnership.

A Limited Liability Partnership (LLP) is formed by two or more people. The owners of the LLP are liable for their own debts and obligations, except those resulting from errors or unlawful acts committed by another partner.