How to Start a Business in Kentucky Checklist:

Stay on task and cover your bases with our detailed checklist.

Download NowHow to Start a Business in Kentucky:

Entrepreneurs looking to start a business in Kentucky will enjoy the state's favorable business location and logistics system, as well as its pro-business tax system, affordable business registration fees, and low cost of living.

If you're hoping to enter the manufacturing, agriculture, coal, or logistics market, then the Bluegrass State is the ideal location. These four competitive industries have plenty of growth potential and have seen great strides in the last five years.

Form your business.

Review Kentucky formation options.

Kentucky offers four ways of forming your business, which we'll cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

When choosing the right name for your business, be sure to consider your services and products, target market, and the brand you're trying to build. Ultimately, your business name should sound unique and modern to help attract customers.

If you need help finding a business name, be sure to check out our free business name generator.

Conduct a name availability search on the Kentucky Secretary of State website to verify that your business name is not the same or similar to another corporation registered in Kentucky.

Once you've verified that your name is available, go to the Kentucky Business One Stop Portal website.

Download the name application form, fill in the necessary details, and pay the $15.00 filing fee.

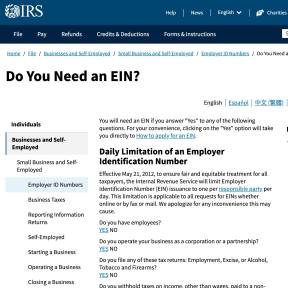

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

Register your business in Kentucky.

Once you've chosen a suitable business name and legal structure, you can officially register your business with the state. Businesses are regulated by Kentucky state laws and must be registered through the Kentucky One Stop Business Portal which is managed by the Kentucky Secretary of State.

To register a business in Kentucky, you'll need to complete and file the articles of formation. The type of formation documents you need to complete will depend on the legal structure you choose. The process for registering a business is the same for most legal structures. However, sole proprietorships and general partnerships are not required to file any formal documents.

It's important to note that all businesses should be registered with the Secretary of State and the Kentucky Department of Revenue. You can register your business with both regulatory bodies using the One Stop Business Portal.

Create an account or log into your Kentucky One Stop Business Portal account.

Search for the formation documents that apply to your business structure.

Complete the formation papers and pay the filing fee.

Submit your documents.

Obtain necessary permits and licenses.

The state of Kentucky does not require businesses to have a statewide business license. You may, however, need to obtain specific business licenses and permits, depending on your business's location, industry, and the products and services you'll offer.

For example, if you're looking to open a restaurant in Kentucky, you'll need to obtain a food handler's permit and a liquor license, both of which are issued by different regulatory organizations in the state.

However, if your new business in Kentucky is selling physical products, you will need to register for Kentucky Sales and Use Tax through the Kentucky Department of Revenue. This applies to most businesses operating in the state.

You can refer to the Kentucky One Stop Business Portal to view a complete list of the most common types of businesses together with information on the licenses and permits required for those types of businesses.

Register your business for taxes.

Register for sales taxes.

Every individual or entity selling personal property in the state of Kentucky is required to pay a sales tax. Services rendered are not taxable. Kentucky Sales and Use Tax is imposed at the rate of 6% of gross receipts or the purchase price.

You will need to register for a sales tax permit with the Kentucky Department of Revenue.

Go to the Kentucky Department of Revenue website or use the One Stop Business Portal.

Search for the Tax Registration Form.

Complete the form and submit it.

Register for withholding tax.

All employers based in Kentucky are legally required to withhold a flat income tax of 5% from salaries and wages. This applies to both resident and nonresident employees. Before registering for withholding tax, read through the Kentucky Department of Revenue's guide regarding withholding tax.

Log onto your One Stop Business Portal or create an account.

Search for the Tax Registration Form.

Complete the form and submit it.

Register for unemployment insurance tax.

In Kentucky, your small business is required to establish a Kentucky unemployment insurance tax account with the Kentucky Career Center. When you register for an account, the details provided will determine if you're liable for unemployment insurance tax.

If your business is required to contribute towards the unemployment insurance tax, you will be given an eight-digit account number and be required to file quarterly reports.

Go to the Kentucky Career Center website.

Click "Unemployment Services" in the home page menu and wait for a drop down menu to appear.

In the drop-down menu, click "If you are an Employer." This should take you to a description on how to apply online or over the phone.

Hire employees and comply with state requirements.

Report newly hired employees to the state.

You will need to register at the Kentucky New Hire Reporting Center when you employ staff. Each employee will need to be reported to the registry within 20 days of their employment date. This does not apply to independent contractors.

Create an account or log in to your account.

Go to the menu in the main page's banner and hover over "Forms" until a drop down menu appears.

In the drop down menu, choose the option "New Hire Form."

Complete the form and submit it.

Obtain workers' compensation insurance.

Kentucky’s law requires all employers to provide workers’ compensation coverage to their employees. An employer is liable for workers' compensation when any injuries, occupational diseases, or death occur due to the job.

You can obtain more information about workers' compensation on the Kentucky Department of Workers’ Claims website.

Display the mandatory workplace posters.

In Kentucky, it's the employer's responsibility to share important information with their employees regarding minimum wage, labor laws, and unemployment insurance, among others. This is done through state-mandated posters that should be displayed in populated spaces in the workplace.

Mandatory Workplace Posters in Kentucky:

- Ky. Minimum Wage.

- Ky. OSHA.

- Ky. Equal Employment Opportunity.

- Ky. Wage Discrimination Because of Sex.

- Ky. Public Accommodation.

- Ky. Unemployment Insurance.

- Ky. Child Labor Laws.

- Ky. Workers' Comp Notice.

- Ky. Fair Housing.

Kentucky Business Types:

1. Sole Proprietorship.

A sole proprietorship is the simplest structure and usually involves one individual who is solely responsible for the enterprise. In Kentucky, you are not mandated to file any formal documents with the state. However, you are still required to adhere to state tax requirements.

2. Partnership.

A partnership is made up of two or more individuals who share managerial responsibilities and profits. There are four main types of partnerships recognized in Kentucky; general partnership (GP), limited partnership (LP), limited liability partnership (LLP), and limited liability limited partnership (LLLP). You are not required to file official formation papers with the state if you're starting a general partnership business.

For those starting an LP, LLP, or an LLLP, you will need to file official formation papers with the Secretary of State. With an LP and LLLP, you must complete and file the Certificate of Limited Partnership form. If you're starting an LLP, you will need to complete and file a Statement of Qualification. The fees for these filings are listed below.

3. Limited Liability Company (LLC).

This is the most popular type because of minimal paperwork, flexibility, tax benefits, and a simple implementation process. With a Limited Liability Company (LLC), business owners are not obligated to file a corporate tax return. To start an LLC in Kentucky, you must complete and submit the Articles of Organization with the Kentucky Secretary of State and pay a filing fee of $40.00.

4. Corporations.

This standalone entity is the more formal structure of the four. With a corporation, you'll generally have a board of shareholders and corporate offices. If you're looking to form a corporation in Kentucky, you'll need to complete and file the Articles of Incorporation with the Kentucky Secretary of State. There is a filing fee of $40.00.

How to Start a Business in Tennessee

Kentucky Business Registration Fees:

Fee Type | Costs |

|---|---|

Certificate of Assumed Name | $20.00 |

Articles of Organization | $40.00 |

Articles of Incorporation | $40.00 |

Certificate of Limited Partnership | $40.00 |

Statement of Qualification | $40.00 |