How to Start a Business in Connecticut Checklist

Stay on task and cover your bases with our detailed checklist.

Download NowHow to Start a Business in Connecticut:

Popular industries in Connecticut include manufacturing, healthcare, insurance and finance, and digital media. This leaves room for a wide selection of business opportunities. Whether you wish to start a healthcare practice or insurance firm, there is room for substantial growth.

Form your business.

Review Connecticut formation options.

Connecticut offers four ways of forming your business, which we'll cover in detail below. Review these closely and pick the one that fits your business best.

Name your business.

Make a list of names that you like and perform a basic Google search to find any conflicts with other Connecticut business names. Follow this with a trademark search to ensure that the business name has not already been trademarked.

After you have confirmed that your business name is not trademarked, visit the Connecticut Secretary of State website and conduct a name availability search to ensure that your business name is not the same or similar to another corporation registered in Connecticut.

If you need help finding a business name, be sure to check out NameSnack's free business name generator.

Go to the Connecticut Secretary of State website.

Choose the "Business Services" option on the right-hand side menu.

Click on the banner that reads "Enter Online Filing System." This will take you to the name availability search bar.

Enter your desired business name ideas and verify if your name is available.

If you're satisfied that your name is available, search for the name reservation form.

Complete the form and pay the $60.00 filing fee.

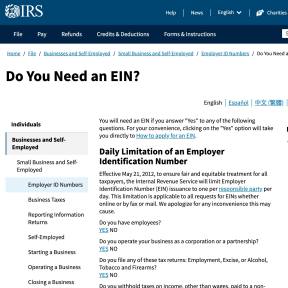

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number.

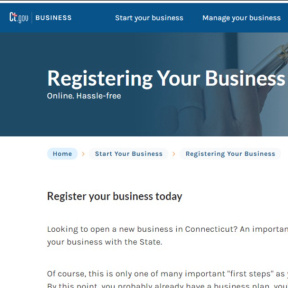

Register your business in Connecticut.

When you've chosen a legal structure and name, you can go ahead and register your business with Connecticut's official state website. Depending on the type of legal structure you chose, you will need to complete specific application forms.

For instance, those starting an LLC in Connecticut would first need to complete and file a Certificate of Organization, whereas those forming a corporation would need to complete and file a Certificate of Incorporation. You will need to pay a filing fee.

Create an account with CT.gov, the Connecticut online business portal.

Once you've created an account, search for the articles of formation document that applies to your chosen business structure.

Complete the articles of formation documents and pay the filing fee.

You can also download the formation form and mail or fax it to the Secretary of State.

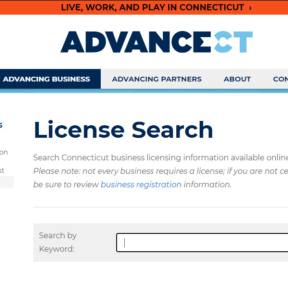

Obtain necessary permits and licenses.

There is no general business license required in the State of Connecticut. Instead, general business licenses are dispensed locally, and they’re not needed for all business types.

For instance, those working in the construction industry would need to obtain a building permit. If you fail to obtain the appropriate licensing and permits, you will be held liable and required to pay a penalty fee.

Common Licenses & Permits Needed in Connecticut:

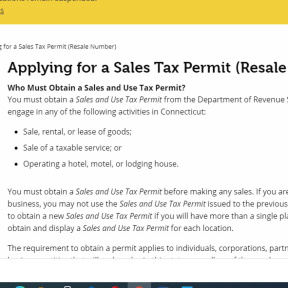

Sales and Use Tax Permit: Businesses must obtain a Sales and Use Tax Permit if they intend to engage the sale, rental, or lease of products, the sale of taxable services, and the operation of a hotel, motel, lodging, or B&B establishment. There is a $100.00 one-time permit fee.

Zoning & Land Use Permit: Zoning permits are issued at a local level by boards and commissions that are made up of local, elected residents. While the filing fee varies by county, you can expect to pay between $40.00 - $200.00.

Signage Permit: A signage or sign permit allows you to publicly display information that presents and advertise your business. There is a $25.00 filing fee.

For a more comprehensive list of the types of permits and licenses you need to start your business, use the business checklist tool provided on the CT.gov business website.

Register your business for taxes.

Determine your tax obligations.

Each business has different types of tax obligations. The taxes you pay is determined by the type of business you own and various other labor, safety, and tax obligations that need to be met. You can visit the Connecticut Department of Revenue or the Taxpayer Service Center for more information on the type of tax you qualify for.

Register for sales and use taxes.

In Connecticut, the statewide rate of 6.35% applies to the retail sale, lease, or rental of most products and services.

You can file and make payments with the Connecticut Department of Revenue Services (DRS) myconneCT online center or over the telephone with the Business Telefile System. If you choose to register online, it's important to note that the fee must be paid through your savings or checking account. No credit card payments are accepted. Your registration could take up to ten days to complete.

For those looking to obtain a seller's permit fast, we recommend registering through your local offices. If you visit during business hours, you will immediately receive a temporary permit.

Register for withholding tax.

An employer is required to withhold tax if the employee is a resident of Connecticut or completing services in the state. You can file electronically with the myconneCT online center, via the telephone with the Business Telefile System, and through the Federal/State Employment Taxes (FSET) program.

Register for corporation business tax.

Corporation Business Tax is required from businesses that file as C corporations for federal income tax purposes. Certain businesses are exempt from Corporation Business Tax.

Business owners must file their Corporation Business Tax Return and make payments electronically by using the myconneCT online center.

Hire employees and comply with state requirements.

Report newly hired employees to the state.

All employers are required to report new hires to the Connecticut Department of Labor within 20 days of hiring them. This does not apply to independent contractors. Employers can report new hires using the Department of Labor's online new hire reporting system.

For submissions by fax or mail, download the CT-W4 Form and fill in the necessary details.

Mail or fax the form to the New Hire Reporting Center. The address information is available on the form.

Get workers' compensation insurance.

All business owners who hire employees are required to obtain workers' compensation insurance. The Connecticut Workers' Compensation Act ensures that all employees who experience a work-related injury, illness, or death receive medical care, protection against income loss, and survivor benefits.

Visit the State of Connecticut Workers' Compensation Commission website for more information on claims and rates.

Display state-mandated posters in the workplace.

In the state of Connecticut, all employers are mandated to display posters that highlight employee benefits, compensation, wages, and workplace safety information. All posters must be displayed in a populated area to ensure that employees have easy access to the information.

For a full list of both state-mandated and federal posters, check out the Connecticut Department of Labor's full list.

Connecticut Business Types:

1. Sole Proprietorship.

A sole proprietorship is the most basic legal structure and consists of one individual who assumes all risk for the business. In Connecticut, you are not required to file organizational documents.

2. Partnership.

A partnership consists of two or more partners who agree to share in all profits, assets, and liabilities. A partnership can come in various structures, including a general partnership (GP) and a limited partnership (LP). Similar to a sole proprietorship, you don't need to file with the state if you're starting a general partnership.

However, if you're starting a Limited Partnership or Limited Liability Partnership, you'll need to complete and file different forms. For instance, a Limited Liability Partnership will need to complete and file a Certificate of Limited Liability Partnership with the SOS.

3. Limited Liability Company (LLC).

An LLC is the most popular business structure as it protects business owners from personal liability. It also provides more flexibility and requires minimal paperwork to set up. Entrepreneurs typically tend to choose the LLC structure due to the fact that it offers all the benefits of a Corporation without the drawbacks, such as double taxation.

To register an LLC in Connecticut, you'll need to file a Certificate of Organization with the Secretary of State. You have the option of filing online or you can download the formation form and file it through the mail, fax, or in-person. If you choose to file online, approval can take between two and three business days.

4. Corporation.

A corporation is a separate entity with shareholders and official offices. To incorporate in Connecticut, you will need to have a Registered Agent service and file a Certificate of Incorporation with the Secretary of State. You can choose to file online or you can download the incorporation form and file it through the mail, fax, or in-person.

Connecticut Registration and Business Fees:

Fee Type | Costs |

|---|---|

Name Reservation | $60.00 |

Certificate of Organization for LLC | $120.00 |

Certificate of Incorporation for Domestic Stock Corporations | $250.00 |

Certificate of Limited Partnership | $120.00 |

Certificate of Limited Liability Partnership | $120.00 |