How to Start a Business in Colorado Checklist:

Download our free checklist in PDF format to help you establish your business in Colorado.

Download NowHow to Start a Business in Colorado:

Registering a business in Colorado is a fairly simple process, with most steps being done on the Secretary of State website. Follow our step-by-step guide below to ensure a smooth registration process for your business, covering all your bases.

Form your business.

Review Colorado formation options.

Colorado offers nine main ways of forming your business, which we cover in detail below. Review these closely and pick the one that fits your business best.

Conduct a name availability search.

Before you try to register your business name, you'll need to be sure that no one else has already claimed it. Start by conducting a name availability search, which will indicate whether a particular name is available. Note, however, that it won't display similar names.

If you need help finding a business name, be sure to try our free business name generator.

Navigate to sos.state.co.us/biz.

Enter the precise name you wish to register.

Be sure to include the designator you'd like to use, such as "LLC" or "Inc."

Click "Search."

View the result. You'll either receive a message that reads "The name is available" or a notification stating that the name is already in use within the state.

Conduct a business database search.

While the name availability search checks for exact matches, the business database search will show similar names to the one you provide but won't indicate whether your favorite name is available.

Navigate to sos.state.co.us/biz.

Enter your search term. You can choose to search by the business or trademark name.

Click "Search."

You'll either receive a message that reads "No results found for the specified name" or a list of results containing matching records. Comb through the latter, if applicable.

Navigate to sos.state.co.us/biz if you'd like to conduct an advanced search, and then simply follow the on-screen prompts.

Reserve your business's name.

Once you've verified that your chosen name is unique, you can reserve it for 120 days. When this period elapses, you can choose to renew your reservation for an additional fee. This will prevent other businesses from claiming your name while you work to establish your business.

Navigate to sos.state.co.us.

Click on "Reserve a name for later use." You'll find this in the section on LLCs, corporations, and trade names.

Enter the precise name you wish to register.

Complete the "Statement of Reservation of Name" form. You'll need to provide some personal and/or business information, including your full name, mailing address, and preferred email address.

Have a look at the field titled "Name to Reserve" to confirm that you've entered the name correctly.

Click "Submit."

View the PDF or open the document in another window.

Check that all of the information you've provided is accurate, and that it has been captured correctly.

If appropriate, tick the box to declare that the data you've provided is correct.

Finalize the name reservation process by paying the $25.00 filing fee.

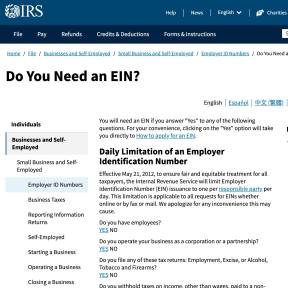

Get an employer identification number.

Nearly all businesses will need to register for federal taxes by applying for an employer identification number (EIN). You have a choice of three key application processes: online (ideal), fax, and mail. International applicants may apply over the phone.

Register your business in Colorado.

The process of registering a Colorado business is fairly simple and is typically done via the SOS website.

Sole proprietors don't need to file any formation documents. However, those who wish to conduct business using a name other than their own first and last names should register a trade name online. Simply complete the "Statement of Trade Name of an Individual" form and pay the $20.00 filing fee.

The same principle applies to general partnerships. If applicable, complete the "Statement of Trade Name of a Non-Reporting Entity" form and pay the $20.00 filing fee.

Limited partnerships can be formed by filing a Certificate of Limited Partnership, which costs $50.00.

Corporations can be established by filing Articles of Incorporation. There are separate forms for profit and nonprofit corporations. Filing fees start at $50.00.

LLCs can be created by filing Articles of Organization. There is a $50.00 filing fee.

Limited liability partnerships (LLPs) can be formed by filing a Statement of Registration, which costs $50.00.

Limited partnership associations (LPAs) can be established by filing Articles of Association. There is a filing fee of $50.00.

Nonprofit organizations (NPOs) that wish to be structured as a nonprofit corporation need to file Articles of Incorporation, which costs $50.00. Those who want to be structured as an unincorporated nonprofit association must simply register their name, which costs $20.00

Cooperatives can choose to register under article 55 or article 56, which entails submitting Articles of Corporation. By contrast, limited cooperative associations should file articles of organization. There are separate forms for registering as a public benefit corporation.

Obtain necessary permits and licenses.

There is no general business license at the state level. However, depending on the nature of your business, you may need to obtain one or more state licenses and/or permits. Examples of regulated professions include:

- Accountants.

- Chiropractors.

- Dentists and dental hygienists.

- Electricians.

- Landscape architects.

- Licensed professional counselors.

- Optometrists.

Be sure to consult Colorado's Boards and Commissions Directory for more detailed information.

Note that businesses may also require one or more local licenses and/or permits. You should contact your local small business development center (SBDC) to learn more about these.

Register your business for taxes.

Create an account with MyBizColorado.

MyBizColorado is the state's official filing tool for businesses and can streamline the process of applying for the main types of tax accounts you'll need.

Navigate to mybiz.colorado.gov.

Click "Start."

Select "Yes" to indicate that you have either registered your trade name or filed your formation documents with the Colorado SOS.

Indicate whether you currently have employees, or whether you will have employees within 90 days from now.

Indicate whether you sell and/or rent products and/or services, or whether you only offer nontaxable services.

You'll be informed thatMyBizColorado allows you to register for sales tax, wage withholding tax, and unemployment tax. Be sure to read the remaining information on the screen.

Make a note of the information you'll need to open the relevant tax account(s).

Enter your email address and a password.

Click "Sign In" to create your account.

Read through the information about unemployment insurance account requirements.

Read through the information about wage withholding account requirements.

Read through the information about sales tax account requirements.

Register for sales tax.

Almost all products and certain services are subject to sales tax, which must be paid to the Colorado Department of Revenue.

Log in to your MyBizColorado account if you'd like to register online. You'll find the option to sign in just below the "Start" button. Then, simply follow the on-screen prompts.

Alternatively, you can complete the relevant sections of the Colorado Sales Tax and Withholding Account Application, otherwise known as Form CR 0100AP. This should be mailed in as directed.

Register for withholding tax.

All businesses that employ staff must withhold income tax if the compensation paid is subject to federal withholding for the purposes of income tax, and if the employees are residents of Colorado and/or nonresidents who conduct services in the state.

Log in to your MyBizColorado account if you'd like to do this electronically. Then, go ahead and follow the on-screen prompts.

Alternatively, you can complete the applicable sections of the Colorado Sales Tax and Withholding Account Application (Form CR 0100AP). This should be submitted via mail.

Register for unemployment insurance tax.

Businesses with employees must also pay unemployment insurance tax. To do this, you'll first need to set up an account.

Once more, you'll need to log in to your MyBizColorado account to complete the application online. There will be on-screen prompts to guide you through the process.

If you'd like to mail through a hard copy application, you'll need to download and complete Form UITL-100, which is also referred to as the Application for Unemployment Insurance Account and Determination of Employer Liability.

Comply with employee-related regulations.

Report your employees to the state.

All newly hired and rehired workers must be reported to the Colorado State Directory of New Hires. This applies to permanent, temporary, and seasonal employees. Contractors who provide you with a social security number (SSN) should also be reported to the state.

The report must be filed within 20 calendar days of the appointment date, or at the time of the first normally scheduled payroll run if this payroll falls outside of the 20-day window.

You'll need to furnish the state with each employee's name and address, SSN, and date of hire. If you wish, you can also report their date of birth. In addition, you'll need to provide your name, EIN, and payroll address.

Navigate to newhire.state.co.us.

Scroll to the middle of the page. Click on "Sign me up" next to "Need Employer Account?"

Follow the prompts to create an online account. This will include checking your inbox for a verification code.

Return to newhire.state.co.us and log in using your credentials. These might be pre-entered for you.

Complete the employee registration process by providing your EIN.

Click on "New Hire Reporting" in the menu bar and follow the prompts based on your preferred method of electronic reporting.

Employers who prefer to submit a hard copy report should download and complete the new hire reporting form, and then fax it to (303) 297-2595 or mail it to the Colorado State Directory of New Hires.

Obtain workers' compensation insurance.

Almost all businesses that employ one or more individuals — whether part-time or full-time — must offer workers' compensation insurance. This coverage can be obtained through:

- Commercial insurance.

- Individual self-funding.

- Group and/or pooled self-funding.

Only the first of these is available to new businesses.

Display all mandatory posters and notices in your workplace.

State regulations stipulate that businesses in Colorado must display several posters and notices prominently in their places of work. These include the:

- Colorado Anti-Discrimination Notices.

- Colorado Employment Security Act poster.

- Colorado Overtime and Minimum Pay Standards (COMPS) Order #36 poster.

- Notice to Employer of Injury poster.

- Notice of Paydays poster.

- Notice of Pregnancy Accommodations poster.

- Workers' Compensation Act poster.

The federal government also requires certain businesses to display several other posters and notices. Further information, including links to each of these, is available on the US Department of Labor's website.

Colorado Business Types:

1. Sole proprietorship.

Sole proprietorships are the most straightforward structure. These businesses comprise one owner/operator who reports the business's profits and losses on their individual income tax return. One key disadvantage is that the sole proprietor assumes personal liability for the business's debt.

2. General partnership.

General partnerships are businesses that are owned by at least two people and/or businesses. Most draw up a partnership agreement that outlines each partner's responsibilities. Regardless of the contents of this document, each partner is completely liable for the business's debt.

3. Limited partnership.

Limited partnerships are businesses owned by two or more people and/or businesses. Contrary to general partnerships, at least one of the owners will have limited liability protection, while the general partner(s) assume personal liability for the business's debt.

4. Corporation.

Corporations are businesses that exist separately from their owners. They are owned by shareholders and managed by a shareholder-elected board of directors, who runs the business. One key advantage is that owners have limited liability. However, the drawback is that corporate profits may be taxed twice.

5. Limited liability company.

Limited liability companies (LLCs) are owned by at least one person. Owners, or "members," are shielded from liability for the business's debt. As far as taxes are concerned, Colorado treats LLCs with two or more members as they do partnerships, unless the LLC stipulates that it would like to be treated as a corporation.

6. Limited liability partnership.

Limited liability partnerships (LLPs) comprise partners that are only personally liable to the extent of their personal investment in the business, except where professional conduct is concerned. LLPs are typically taxed in the same way as partnerships unless they choose to be taxed as corporations.

7. Limited partnership association.

Limited partnership associations (LPAs) can have an indefinite lifespan. That is, they continue to exist even when one or more partners disassociates, becomes bankrupt, or passes away. This is a relatively new business structure, so there are limited interpretive guidelines at present.

8. Nonprofit organization.

Nonprofit organizations (NPO) use their revenue to further their goals. In Colorado, nonprofits can choose to register as a nonprofit corporation or an unincorporated nonprofit association. The former option is recommended for entities that wish to achieve tax-exempt status or exist beyond its current organizers, while the latter is ideal for less formal groups.

9. Cooperative.

Cooperatives are legal entities that are established by people and/or businesses looking to collaborate for their cooperative benefit. This could include teaming up to purchase in bulk, sell common products, and/or share an office space. Each member of the cooperative remains classified as an individual or an individual business.

Cooperatives can register as an unincorporated association — or a "limited cooperative association" (LCA) — but most choose to organize as a corporation. This limits each member's personal liability to the extent of their equity in the system. Another advantage of this structure is that ownership and control can be transferred easily.

Individuals wishing to operate a single, independent business should look to one of the other structures mentioned above.

How to Start a Business in New Mexico

Fees for Starting a Business in Colorado:

Fee Type | Online Fee | Paper Fee |

|---|---|---|

Expedited Filing Service | n/a | $150.00 |

Articles of Incorporation (Profit and Nonprofit Corporations) | $50.00 | n/a |

Articles of Incorporation for a Corporation Sole (Nonprofit) | n/a | $125.00 |

Articles of Incorporation for an Article 55 Cooperative Association | $50.00 | n/a |

Articles of Incorporation for an Article 56 Cooperative Association | $50.00 | n/a |

Articles of Organization for a Limited Cooperative Association | $50.00 | n/a |

Articles of Organization for a Limited Liability Company | $50.00 | n/a |

Articles of Association | $50.00 | n/a |

Certificate of Limited Partnership | $50.00 | n/a |

Combined Certificate of Limited Partnership and Statement of Registration | $50.00 | n/a |

General Partnership Registration (LLP) | $50.00 | n/a |

Limited Partnership Registration (LLLP) | $50.00 | n/a |

Limited Liability Limited Partnership Registration (LLLP) | $50.00 | n/a |

Foreign Entity Authority Statement | $100.00 | n/a |

Name Reservation | $25.00 | n/a |

Name Reservation Renewal | $25.00 | n/a |

Trademark Registration | $25.00 | n/a |