IRS Application for EIN — Download (2023)

Download IRS form SS-4 Application for Employer Identification Number and begin the process for your EIN.

Download NowHow to Apply for an EIN Online:

A step-by-step guide on how to apply for an EIN online.

Prepare for the application process.

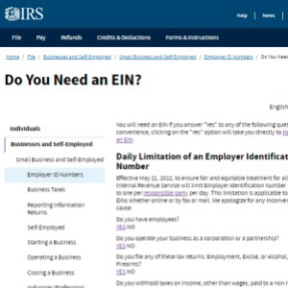

Check whether you need an EIN.

Not every business needs to get an Employer Identification Number, but some are required to by law. Visit the IRS website to find out if you need to get an EIN for your business.

It is a good idea to get an EIN anyway because banks often ask for one when processing business loan applications.

Go to the "Do You Need an EIN?" page on the IRS webiste.

Answer the "Yes / No" questions.

If you answer "Yes" to any of the questions, follow our next step.

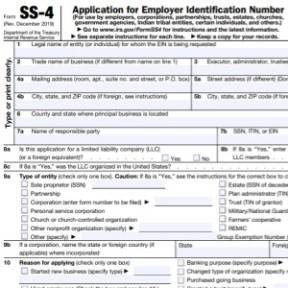

Download Form SS-4.

While it is unnecessary to fill in and file any forms when applying for your EIN online, it is a good idea to download Form SS-4 beforehand. This way, you can prepare all the information you'll need and won't run the risk of having to start again after 15 minutes of inactivity because you were unsure of something.

Gather all the information needed to fill in the form.

Answer all the questions in the form before starting the online process.

Read and understand the requirements.

These are the requirements given by the IRS:

- You have to complete the process in one session. You lose any progress made after 15 minutes of inactivity.

- You must have a valid U.S. ID number.

- You must have a valid Taxpayer Identification Number.

Start the online application process.

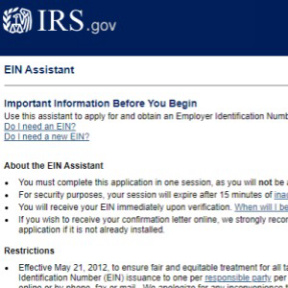

Read about the EIN Assistant.

When the EIN Assistant launches, a window with information about the Assistant and a list of restrictions opens. Read and understand all the information. Click "Begin Application" when you're ready.

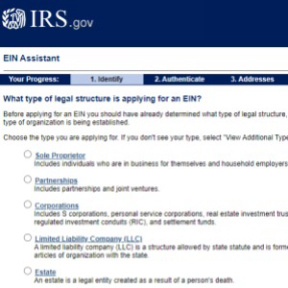

Identify your business.

Section 1 is titled "Identify." In this section, you will have to select your company's legal structure, give basic details about members and your business's location, and choose a reason for your application.

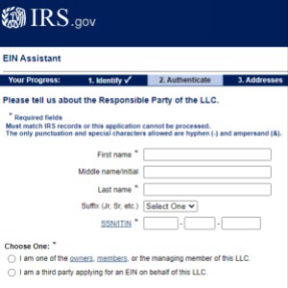

Authenticate the information.

The second section is titled "Authenticate." In it, you will have to provide accurate personal information about the "responsible party." As the owner of the business, the responsible party will most likely be you. The information you give here must match IRS records.

Give all relevant addresses.

Section 3 is titled "Addresses." In this section, you will have to give a mailing address and a physical location of the business.

Provide details of the business.

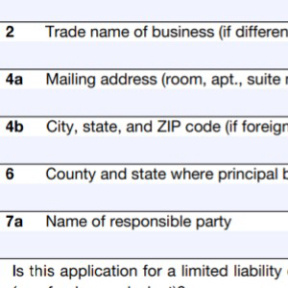

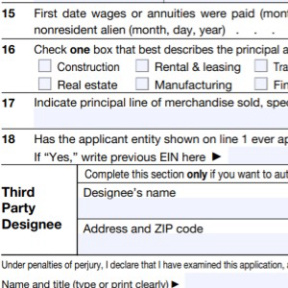

Section 4 is titled "Details." In this section, you will be asked to provide the legal name of the entity, the trade name of the business, the number of employees, the date the business started, basic tax information, and what the business does.

Await confirmation.

You should receive your EIN as soon as you complete the online application process. You can then begin using it.

Three Alternative Ways to Apply for an EIN:

1. Apply for an EIN by fax.

Processing time: 4 days.

- Download Form SS-4 and fill it in.

- Double-check that all the information is accurate.

- Make sure to include your fax number.

- Fax the form: (855) 641-6935.

2. Apply for an EIN by mail.

Processing time: 4 weeks.

- Download Form SS-4 and fill it in.

- Double-check that all the information is accurate.

- Send to: Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999.

3. Apply for an EIN by telephone.

Processing time: immediate.

- Download Form SS-4.

- Familiarize yourself with the questions and requirements.

- Call: 1 (267) 941-1099 between 6 a.m. and 11 p.m., Monday to Friday.

- Answer the questions.

- When you receive the confirmation documents, you'll need to sign them to make your EIN valid.